how to check unemployment tax refund amount

If you began receiving unemployment compensation in April or June of 2020 the deadline to make estimated tax payments has been extended from April 15 and June 15 to July 15 2020. As of early November the IRS had issued more than 117 million refunds totaling 144 billion.

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

Check the status of your refund through an online tax account.

. You did not get the unemployment exclusion on the 2020 tax return that you filed. A fter more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for. The next wave of payments is due to be made at some point in mid-June but until then you may be able to work out how much you will receive.

People who received unemployment benefits last year and filed tax. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online.

The IRS will determine the correct taxable amount of unemployment compensation and tax. System to follow the status of your refund. You will need your social security number and the exact amount of the refund request as reported on your income tax return.

Will I receive a 10200 refund. The IRS will determine the correct taxable amount of unemployment compensation. The gross amount of unemployment from your 1099-G will be on line 7.

You may check the status of your refund using self-service. The amount that you receive. Check For the Latest Updates and Resources Throughout The Tax Season.

Another way is to check your tax transcript if you have an online account with the IRS. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. My unemployment actually went to my turbo card.

UI Tax Refund and Overpayment Info. The Internal Revenue Service doesnt have a separate portal for checking the. Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund.

This is available under View Tax Records then click the Get Transcript button and choose the federal tax option. You can try the IRS online tracker applications aka the. The exact amount you are owed as a.

Already filed a tax return and did not claim the unemployment exclusion. One way to know the status of your refund and if one has been issued is to wait for the letter that the IRS sends taxpayers whose returns are corrected. The deduction up to.

Look at Schedule 1. To take advantage of the useful resources you will simply need to input the following information. Your social security number or ITIN.

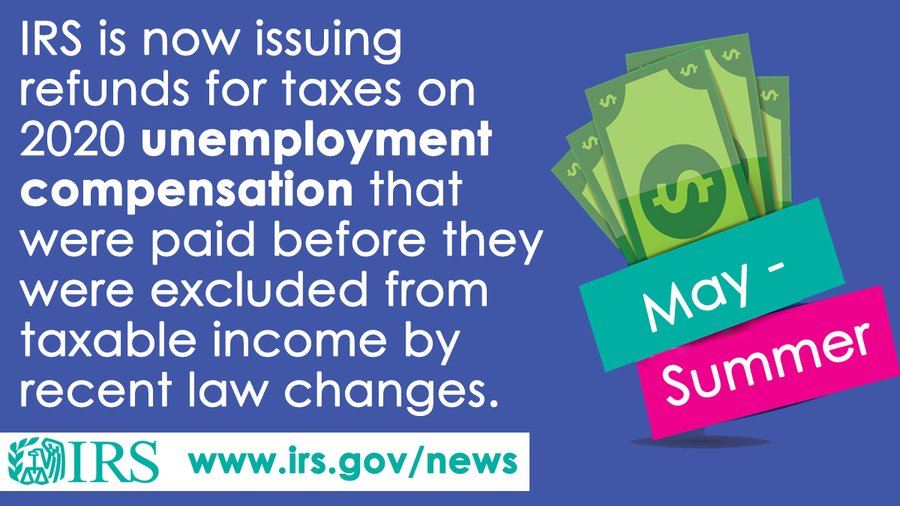

Updated March 23 2022 A1. The American Rescue Plan Act allows eligible taxpayers to exclude up to 10200 up to 10200 for each spouse if married filing jointly from their gross income which will likely lower the tax liability. An immediate way to see if the IRS processed your refund is by viewing your tax records online.

You reported unemployment benefits as income on your 2020 tax return on Schedule 1 line 7. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan.

24 and runs through April 18. The 10200 is the amount of income exclusion for single filers not the amount of the refund. First-time users must register for Portal access.

Unemployment tax refund status. The payment considers your expected income and tax credits. Amended Return Status tool but they may not provide information on the status of your unemployment tax refund.

Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit. These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022. Have an adjustment because of the exclusion that will result in an increase in any non-refundable or refundable credits reported on the original return.

11 Feb 2021 1140 AM Anonymous. Keep in mind you arent going to. After this however estimated tax payments will still be required according to the normal schedule.

2021-22 Board of Directors. Wheres My Refund tool and the. The unemployment exclusion would appear as a negative amount on Schedule 1 line 8.

After this you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued. The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for. Already filed a tax return and did not claim the unemployment exclusion.

You will get a federal income tax refund for the unemployment exclusion if all of the following are true. The IRS will send you a notice to let you know if youre affected. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

Overpayment information can be viewed on the Employer Dashboard page of the Employer Portal. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt. If youre anticipating an unemployment tax refund your best bet is to track the status of it and see when it would arrive in your bank account.

This handy online tax refund calculator provides a. Since may the irs has issued more than 87 million unemployment compensation tax. Approval and loan amount based on expected refund amount eligibility criteria and underwriting.

Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962. COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax. This is the fourth round of refunds related to the unemployment compensation exclusion provision.

During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. Generally the sooner you file your taxes the sooner youll see your refund in the bank and it reduces the chances of tax fraud. As many as 16 million Americans might be eligible for a refund.

December 28 2021 at 1013 pm. Today the IRS published the latest executive column A Closer Look which features Commissioner Wage Investment and Chief Taxpayer Experience Officer Ken Corbin discussing how the IRS prepares to process more than 150 million tax returns and issue more than 400 billion in refunds to taxpayers. For eligible taxpayers this could result in a refund a reduced balance due or no change to tax.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Unemployment Refunds What You Need To Know

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

How Will Unemployment Tax Break Refund Be Sent In Two Phases By The Irs As Usa

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

1099 G Unemployment Compensation 1099g

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest

How To Find Your Irs Tax Refund Status H R Block Newsroom

Unemployment Tax Break Refund How To Check Your Irs Transcript For Clues

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Fury As Major Tax Refunds Are Delayed For Millions Of Americans Because Irs Staffers Are Working From Home

Interesting Update On The Unemployment Refund R Irs

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time